SASB FSA Credential – What you need to know (Part II)

ESG & Sustainability

Source: FSA Candidate Handbook

I have recently become an FSA credential holder, and looking back this has been a very rewarding experience. I enjoyed the preparation and have learnt a lot. There are not many articles in the market talking about how their experience was and if there is anything they should know beforehand, so I hope you will find this useful.

This article is divided into Part I and Part II:

>> Part I: Background and common questions about the Exams

>> Part II: Dive into the exams’ outline and my way of preparation (this article)

Please note that most of the information can be found in: FSA Overview — SASB and candidate handbook: https://sasb.org/fsa/fsa-candidate-handbook/. You should always refer to the official website for the latest updates.

Curriculum Outline

Level I (11 Chapters)

Part I: The Need For Sustainability Accounting Standards

>> 1. Demand for Sustainability Information

>> 2. The Historical Basis for Disclosure

>> 3. The Shortcomings of Financial Disclosure

>> 4. Sustainability Disclosure Guidance Among Global Jurisdictions

>> 5. The Sustainability Disclosure Ecosystem

>> 6. Materiality Throughout Global Jurisdictions

Comment:

- This part is nicely structured which summarizes the background on how the market went from financial disclosure-only to the rise of sustainability disclosure.

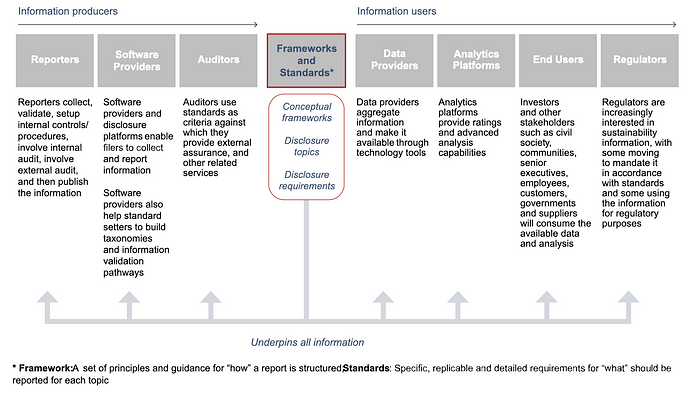

- In particular I like Chapter 5 the most as it lays out the sustainability disclosure value chain in the market (see below). This is super useful as you can identify relevant stakeholders within your industry, or even plan your ESG career by identifying which parts of the value chain you would like to go to.

Source: https://www.sasb.org/about/sasb-and-other-esg-frameworks/

- For example, after studying Part I, you should be able to answer:

What is the definition of materiality?

What are the four financial statements, and their limitations?

What are the fundamental characteristics of qualitative information?

What are the unique challenges of sustainability reporting?

Part II: Understanding SASB Standards

>> 7. Introduction to SASB Standards

>> 8. Setting SASB Standards: Identifying Disclosure Topics and Metrics

>> 9. How Companies Disclose Using SASB Standard

Comment:

- After understanding the big picture and market environment via Part I, Part II is focusing on SASB standards only.

- For example, after studying Part II, you should be able to answer:

What are the primary and additional objectives of SASB standards?

How to differentiate “Accounting metrics” and “Activity Metrics”?

What are the four fundamental tenets?

What is SASB conceptual framework?

What are the characteristics of SASB disclosure topics?

What is SICS (Sustainable Industry Classification System)?

Why do companies report using SASB Standards?

Where do companies disclose using SASB Standards?

What sustainability information is the company reporting?

How is sustainability information being disclosed?

Part III: Using SASB Standards

>> 10. Corporate Use

>> 11. Investor Use

Comment:

- This session elaborates on how corporations and investors use SASB standards.

- For example, after studying Part III, you should be able to answer:

What are the steps involved in preparing for company disclosure?

How to prepare quality data?

What are the steps involved in reporting financial material sustainability data?

What are the four stages of value creation?

What is the spectrum of sustainability-related investment?

What is fundamental analysis?

How to construct an index and work on sector allocation?

What is post-investment engagement?

Level II (9 Chapters)

Part I: Identifying The Sustainability Issues Relevant To Financial Performance

>> 1. How a Company’s Circumstances Influence Material Sustainability Issues

- Understanding Sustainability Issues

- Evaluating Sustainability Issues

Comment:

- I think Part I is the fundamentals of the whole Level II exam and highly recommend you spend more time understanding and memorizing the details.

- For example, after studying Part I, you should be able to answer:

What are the external/internal factors which will affect a company’s sustainability issues?

What are the sustainability issues being stated in “Human Capital”?

How are the sustainability issues interlinked with each other?

What is the difference between customer privacy and data privacy?

What are the 5-factors in evaluating sustainability issues?

Part II: Evaluating The Comparability Of Sustainability Information

- Normalizing Data for More Effective Comparisons

- Analyzing the Spread of Industry Performance

- Considering Company-Specific Context

Comment:

- Part II is the quantitative part where you will learn about the concept of normalisation and standard deviation.

- For example, after studying Part II, you should be able to answer:

What are the best metrics to normalize the following indicators: environmental, social capital, human capital, business & innovation and leadership & governance?

What are the questions you need to ask yourself to understand if normalisation is needed?

How to calculate the standard deviation of a metric and learn about its performance compared with its peers?

How can we know if the set of data is negatively/ positively skewed?

How to incorporate a company’s operating environment into the data comparison

Part III: The Connection Between Sustainability Performance And Valuation

>> 7. Characterizing Financial Impact

>> 8. Using Sustainability Data in Financial Valuation

>> 9. Integrating ESG Beyond DCF

Comment:

- This is the gist of the Level II exam — linking sustainability issues with financial performance. For those who do not have a financial background might need to do revision multiple times to understand the concepts and specialized terms.

- For example, after studying Part III, you should be able to answer:

What are the characteristics of financial impact?

What are the process to identify the financial impact of a topic?

What are the components in discounted cash flow analysis?

What are the example metrics for revenue, expenses, assets & liabilities, cost of capital?

Define ROIC (return on invested capital), EVA (economic value added) and scenario analysis

Points to note during your study

- Grey boxes within each chapter: They are not testable materials in the exam. But I recommend you not to skip this part as these extended materials can deepen your understanding of a particular topic.

- “Check your understanding” after each chapter: a very useful set of questions to test if you fully understand the chapter

- “Putting it into practice” after each chapter: a set of case studies which test your understanding, but it does not mimic the real exam questions.

- “Test your understanding” questions after each part and at the end of the study materials: Super useful! The question type is very similar to the actual exam. Highly recommend you go through all the sample questions once again on the day of the exam.

Points to note during the actual exam

- Some questions and answers are not straightforward.

- There are usually 4–6 answers to a question, and all of the answers could make sense/applicable. You need to study the questions carefully. For example, a question might ask about the financial impact of cash flows on environmental issues, and you should exclude answers related to social issues.

- Also, be aware of the keywords “not”/ “excluded”/ “incorrect” in the question.

- Use the bookmark function in the exam system so you can prioritize the questions to revisit at a later stage, as there are 110 questions in the Level I exam and 55 in Level II.

For the Level II exam:

- The FSA has suggested candidates complete one case study within 6–8 minutes. You will have the case study on the left, and MCQ on the right. There is also a typing pad and digital calculator for your use.

- Within one case study, there are usually both paragraphs and a metrics table. I will read the paragraphs to understand the background first, and then the questions.

My study tips

- It is often hard to balance work, study, and personal life. For me, I planned to study at least two months before the actual exam date.

- It is hard for me to find time after work to study so I will usually study at the weekend so I can block several hours. Weekday will be for revision/ working on test questions instead.

- I made palm-size revision cards so I can revise during my commute.

- Always take note of the questions you have done wrong/ difficult concepts to remember. So you can prioritize them during your revision.

Comments